Cash Store Blog

How to Choose the Right Savings Account

When was the last time you checked in on the health of your savings account? If you are like many Americans, the chances are that your savings account isn’t sitting as pretty as you would like it to be. About 25% of us have less than $1000 put away for a rainy day or an emergency. And we’re here to tell you that if you don’t have at least $500 ready to go for those unexpected incidents, it’s time to make savings a priority.

However, you need a place to be able to put those funds so that you don’t inadvertently spend it. But where do you do it? The obvious answer is a savings account, yet not all savings accounts are the same.

In this article, the Cash Store team shares some insights to help you choose the best savings account for your financial needs.

Understanding the Different Types of Savings Account

When you are setting aside money, you want that money to give you something back, especially when you aren’t spending it. And when the guideline is to save at least 20% of your income as part of your budget, you could be missing out on a lot of interest that may help those dollars grow.

Here is an overview of the different types of savings accounts for you to consider.

Basic Savings Accounts

These savings accounts are simple and easy to manage, making them ideal for new savers. They typically offer features like deposit and withdrawal capabilities with no complex terms or conditions.

- Pros: Basic savings accounts are easy to open and maintain, often requiring a low minimum balance.

- Cons: They generally offer low interest rates, meaning your savings will grow slowly compared to other options.

High-Yield Savings Accounts

These accounts are designed to provide a higher return on your savings compared to basic savings accounts. They are perfect for individuals looking to maximize their earnings without taking on significant risks.

- Pros: These accounts offer higher interest rates, which can significantly add to your savings over time.

- Cons: They may come with requirements such as higher minimum balances and limited withdrawal options.

Money Market Accounts

Accounts that Combine Features of Savings and Checking Accounts

Money market accounts offer a blend of savings and checking account features, providing flexibility while earning interest. They are a good choice for those who want both accessibility and growth.

- Pros: Money market accounts typically offer higher interest rates than basic savings accounts.

- Cons: They often have transaction limits, restricting your ability to access funds frequently.

Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are fixed-term investments that offer higher interest rates in exchange for leaving your money untouched for a set period. They are ideal for savers with specific long-term goals.

- Pros: CDs provide higher returns compared to regular savings accounts due to the fixed term.

- Cons: They impose penalties for early withdrawal, making them less flexible for those needing access to their funds before the term ends.

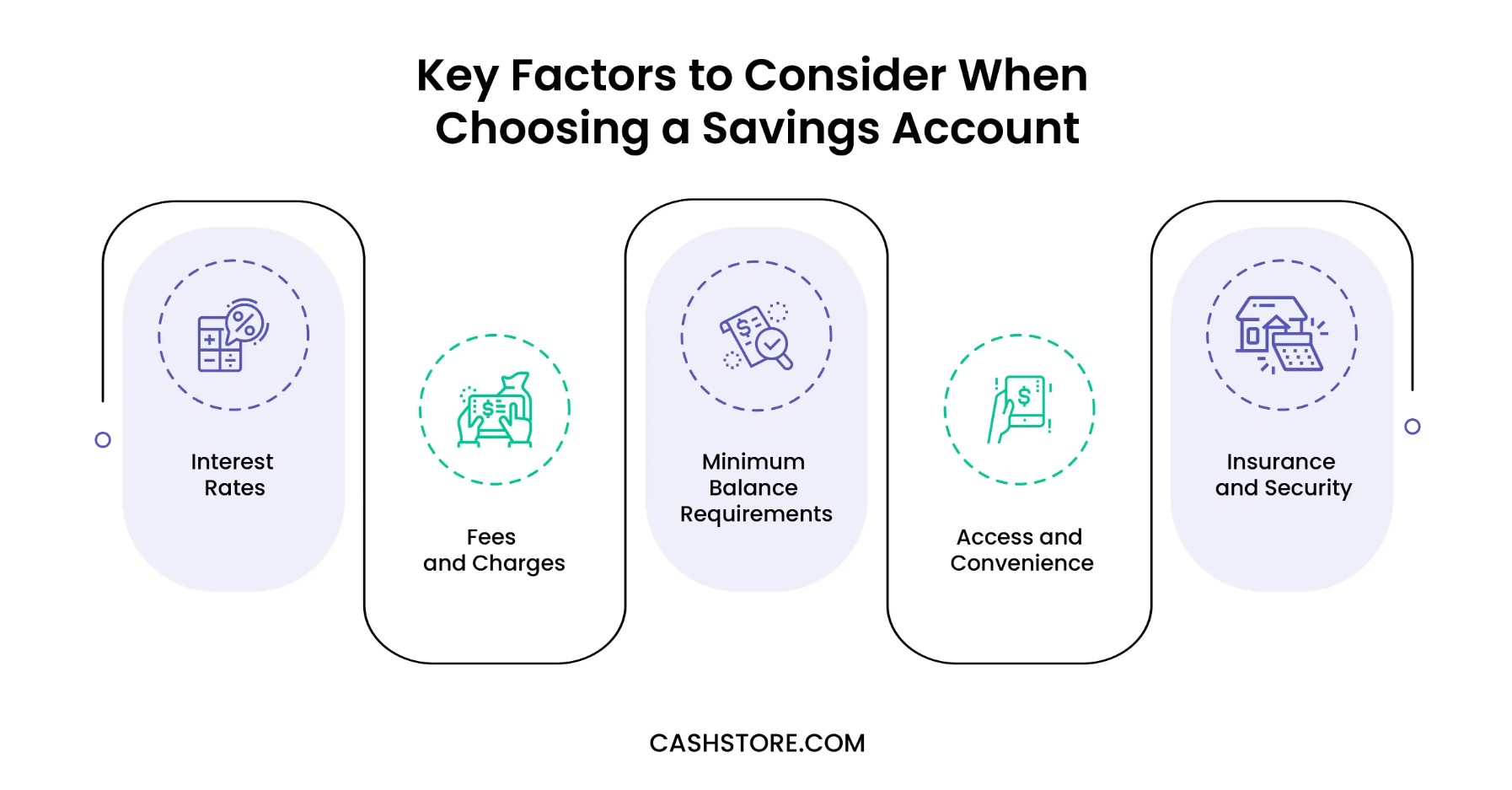

Key Factors to Consider When Choosing a Savings Account

Many people start a savings account based on advice from a family member or friend. However, what matters to them might not be the same as what matters to you. Plus, you may have different goals and objectives. That’s why deciding for yourself is so important.

Here are some of the factors to consider that may help you make the best choice.

Interest Rates

Interest rates determine how much your savings will grow over time. Higher interest rates mean more significant returns on your deposits, which could help you reach your financial goals faster.

To find competitive rates, research different banks and compare their offerings. Understanding annual percentage yield (APY) is a must as it represents the actual annual rate your money will earn, accounting for compound interest.

Fees and Charges

Savings accounts may come with various fees, such as monthly maintenance fees, transaction fees, and withdrawal penalties. These fees may eat into your savings if not carefully managed.

Choose accounts with no or low fees, and be mindful of transaction limits. Look for banks that offer fee waivers if you meet specific criteria, such as maintaining a minimum balance or setting up direct deposits.

Minimum Balance Requirements

Minimum balance requirements dictate how much you need to keep in your account to avoid fees or earn interest. Falling below this threshold could result in penalties.

Select accounts with minimum balance requirements that you can comfortably maintain. Consider your financial situation and choose an account that aligns with your ability to meet these requirements without straining your budget.

Access and Convenience

Easy access to your funds is essential for managing your savings effectively. Consider how you can deposit, withdraw, and transfer money between accounts.

Look for accounts that offer robust online banking features, extensive ATM networks, and convenient branch locations. Mobile banking apps can also provide unmatched accessibility, allowing you to manage your account on the go.

Insurance and Security

Protecting the money in your savings account needs to be a top priority. Federal insurance guarantees the safety of your deposits up to a certain limit, protecting you from bank failures.

Choose accounts that are insured by the Federal Deposit Insurance Corporation (FDIC) for banks or the National Credit Union Association (NCUA) for credit unions. Additionally, assess the bank’s security measures, such as encryption and fraud monitoring, to keep your funds and personal information safe.

Cash Store is Here to Help

Figuring out how to manage your budget takes time and ongoing dedication. But whether you are saving $5 a day or have a goal of $50 a month, be sure to come up with a plan and take steps to achieve it. You never know when that emergency fund will come in handy.

That said, if you find yourself strapped for cash and need funds for an emergency, Cash Store may help. We offer cash loans and installment loans, designed to get you the money you need when you need it most. Apply today.