Unlocking the Mystery: Exploring Credit Score Ranges for Financial Success

Understanding your credit score is a critical component of responsible financial management. A good credit score can afford you various options, too, from lower interest rates to higher borrowing limits, plus more borrowing flexibility. But what is a good credit score, anyway? The answer to this lies in the credit score ranges.

What are the credit score ranges?

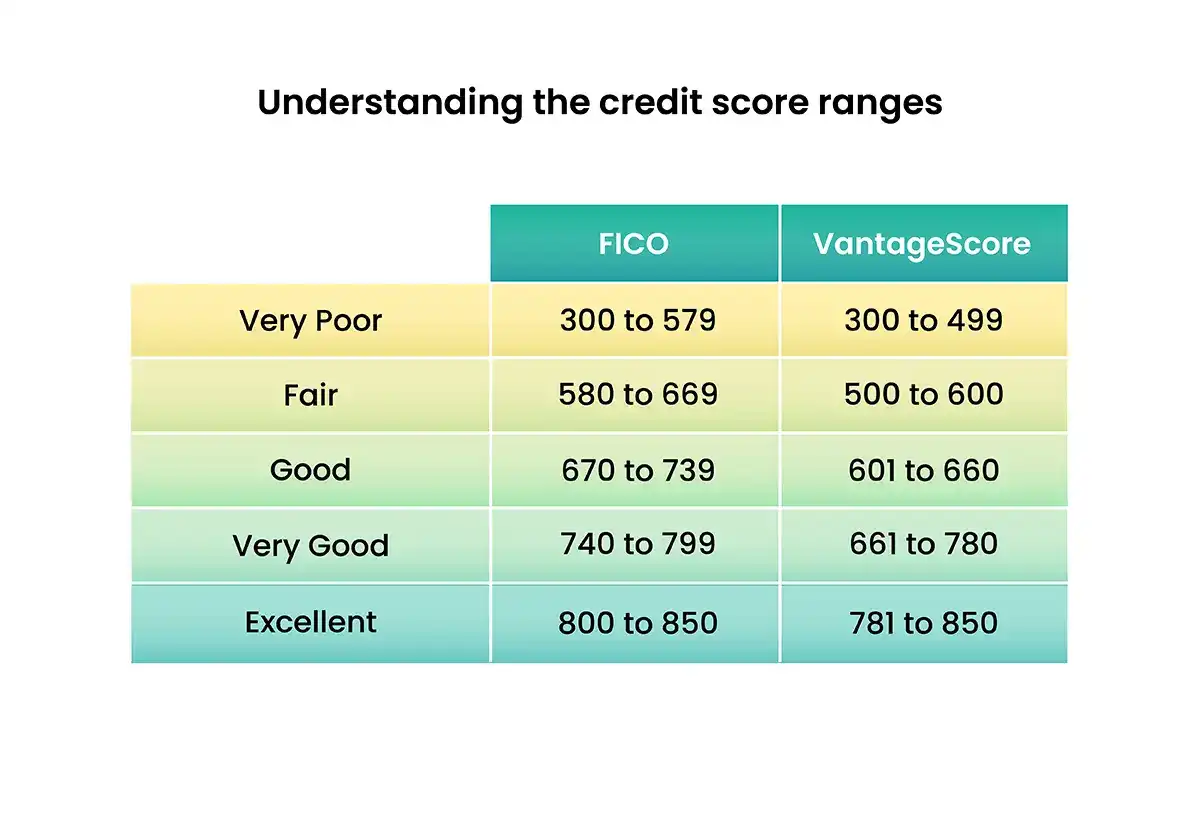

Your credit score is calculated in one of two ways. FICO is the more traditional of the two models, and the Vantage Score was created in 2006 in partnership with the three credit bureaus as a competitive option to FICO. Both scoring models range from 300 to 850, and your creditor can select which methodology to adopt.

The FICO and VantageScore credit score ranges are as follows:

Though the ranges are essential, it is less critical to try to fit within one range or another. Instead, focus on building a credit score in the 700s or higher. For example, at the end of 2022, the average credit score was 714, which is consistent with what it was in 2021. This score fits nicely in the good range of both score ranges. Consumers with a 714-credit score are often eligible for all those benefits we mentioned – favorable interest rates, higher credit limits, and better terms. But how do you get to a good credit score?

How your credit score is calculated

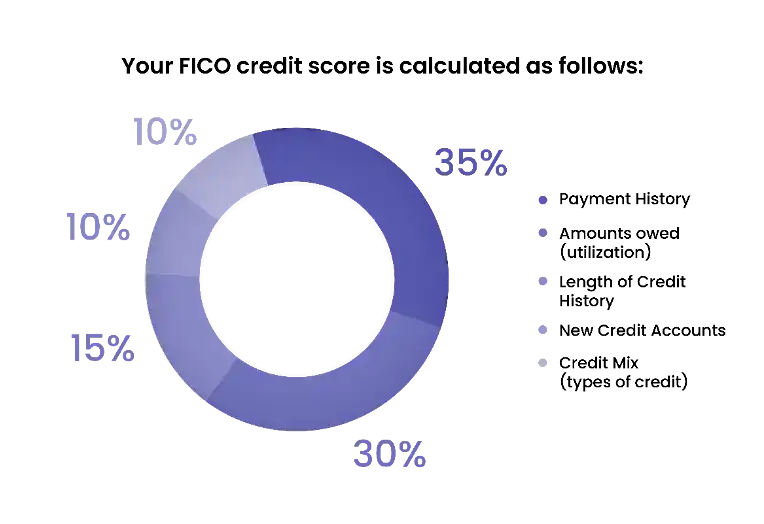

Just as with the score ranges, the FICO and VantageScore have slightly different ways of calculating your actual score. Here’s how it works:

As you can see, both scoring methods heavily consider your payment history in calculating your credit score. And your utilization is the next most important factor. Your utilization compares your credit card balances (in total) to your credit card limits (in total). As a rule of thumb, you want to keep your utilization under 30%. If you have a $5,000 credit limit, you should keep your balance at $1,500 or less.

Now that you know the credit score ranges and how your credit score is calculated, you should know how to build your credit in the first place and how to work your way to a good or better credit score.

How to get a good credit score

If the average credit score in the U.S. is 714, it is a possible score and a good one to work towards. Building your credit from scratch takes about six months, but you won’t usually get a good credit score immediately. Plus, it would help if you had some credit for that score to be generated in the first place. Some of the best options to build your credit score include:

- Becoming an authorized user on a trusted family member’s credit card account

- Taking out a credit builder loan

- Applying for a secured credit card

- Getting a student loan

- Getting an auto loan for consumers with no credit

- Using a product such as Experian Boost to get credit for utility payments and streaming services

As we said, building that initial score will take you about six months. During those six months, your creditors will report to the credit bureaus about how well you manage your credit. Most specifically, they’ll report on your spending habits (the balances on your credit cards) and how well you pay your bills.

Once you have an initial credit score, your goal should be to improve it as much as possible. Here’s how to obtain a good credit score.

- Pay your bills on time, all the time. You must be prepared to make your minimum monthly payments on time every month. If you fail to make a payment and don’t make it up within 30 days, you will be subject to late payment fees, and your credit score could drop by as much as 180 points.

- Manage your utilization. If you have credit cards, ensure your total balances do not exceed 30% of your total credit card limits. And make sure you are thinking when making purchases, too, as the more you spend, the higher your required minimum monthly payment will be.

- Pay attention to your credit mix. Creditors don’t like seeing too many credit cards or installment loans on your credit history. A healthy credit balance could be a rent payment or mortgage, a student loan, an auto loan, an installment loan, and maybe one or two credit cards. Even though credit card offers may seem lucrative, it is often best to avoid the temptation.

- New credit. As we said, opening up new credit accounts can be tempting, especially when they have fun perks and rewards. But every time you apply for new credit (except for installment loans such as from Cash Store), a hard credit inquiry is pulled on your account. This can drop your credit score by five points and remain on your credit report for up to two years.

The name of the credit game is responsibility and diligence

To build a good credit score, the key is responsible spending, perseverance, and diligence. Ensure you can pay your bills on time, and don’t bite off more than you can chew. With responsible spending habits and an on-time payment history, your credit score will work towards a good range. And that will pay off for you in dividends.

*The content on this page provides general consumer information or tips. It is not financial advice or guidance. Each person’s circumstances are unique. The Cash Store may update this information periodically. This information may also include links or references to third-party resources or content. We do not endorse the third-party or guarantee the accuracy of this third-party information. There may be other resources that also serve your needs.

More Articles

What to Know About Crypto-Backed Loans

Curious about using your crypto as collateral? Discover how crypto-backed loans work, their benefits, risks, and what to consider before borrowing.

Read More >How Does Installment Loan Approval Work?

Curious about how installment loan approval works? Learn about the key factors lenders consider, the application process, and tips to improve your chances of approval.

Read More >Is it Better to Get an Installment Loan or Line of Credit?

Installment loan or line of credit—which is right for you? Learn the key differences, pros and cons, and how to choose the best option for your financial needs.

Read More >Loan Amount is subject to loan approval. Loan terms and availability may vary by location. Approval rate based on complete applications received across all Cash Store locations. Customers can typically expect to receive loan proceeds in less than 20 minutes; however, processing times may vary. Loans / Advances are provided based on approved credit. Each applicant for credit is evaluated for creditworthiness.

Please see the Licenses and Rates page for additional product details.

Cash Store offers consumer credit products that are generally short-term in nature and not intended for long-term borrowing needs.

In Texas, Cash Store is a Credit Services Organization. Loans are provided by a non-affiliated third-party lender. Please see the Licenses and Rates page for links to Consumer Disclosures and choose the one for the product and amount that most closely relates to your loan request.

Customer Portal residency restrictions apply. Availability of funds may vary by financial institution.