Cash Store Blog

How to Become Financially Literate? Free Personal Finance Courses

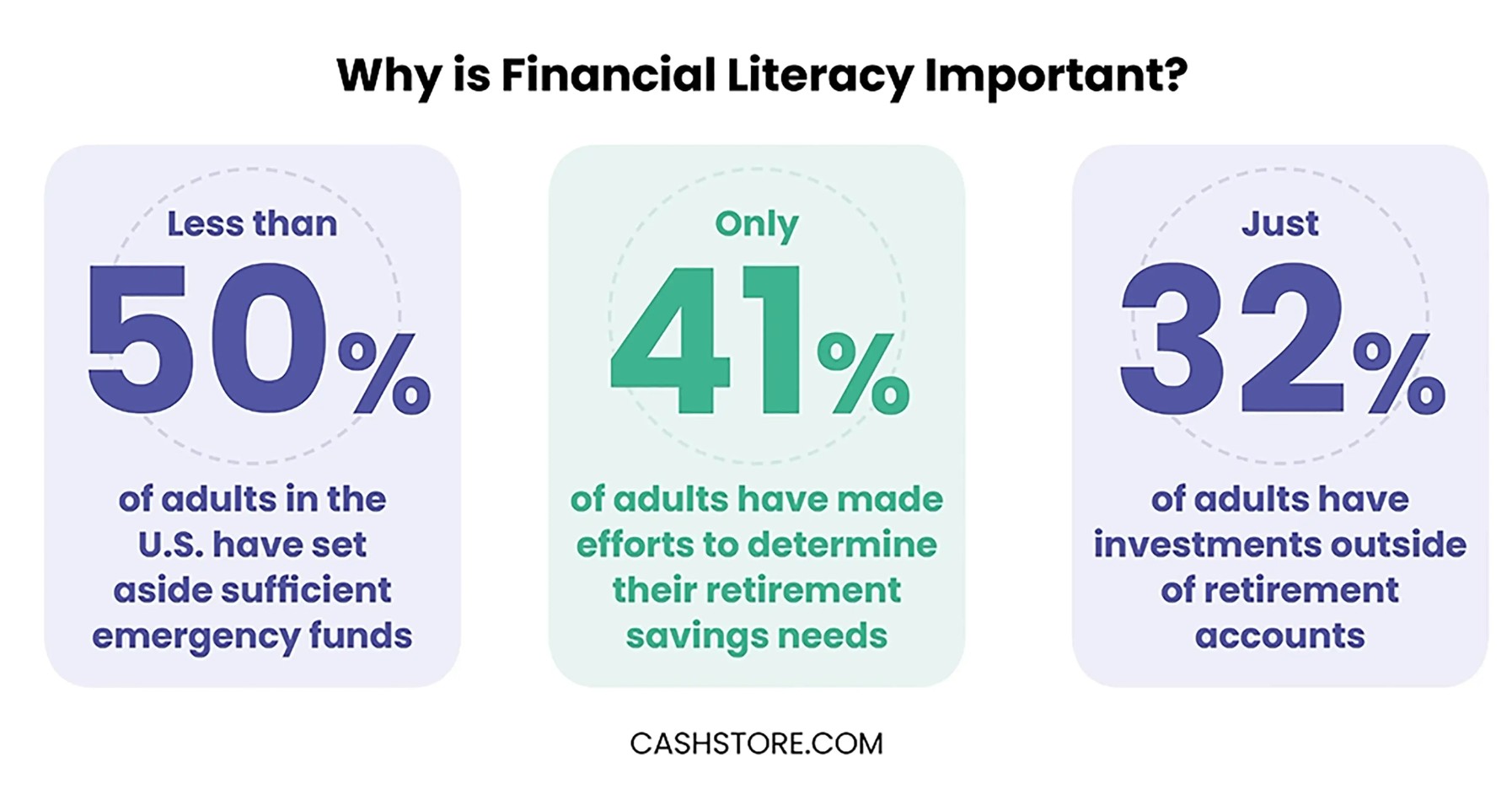

Many Americans believe they have a firm grasp of financial literacy. In fact, approximately 71% of American adults consider themselves to possess a high level of financial literacy. However, statistics paint a different picture, as less than 50% of adults in the U.S. have set aside sufficient emergency funds.

Plus, only 41% have made efforts to determine their retirement savings needs, while just 32% have investments outside of retirement accounts. And so though many say they are financially literate, we’re afraid that the statistics paint a different picture.

What is Financial Literacy?

And so this begs the question, just what is financial literacy? Many people don’t understand that it goes beyond basic budgeting skills and includes understanding concepts such as investments, savings, and retirement planning. By building financial literacy, individuals can better equip themselves to manage anticipated and unforeseen life events.

So, why do we care at Cash Store? After all, we’re in the loan business. But the truth is that increased financial literacy leads to greater financial resilience, allowing individuals to handle financial challenges with confidence. And despite the business that we are in, we want to help Americans of all ages become smarter with their money and set themselves on the path to financial wellness.

Learning how to earn, spend, save, and invest wisely contributes to one's financial well-being and overall stability in life. But just how do you become more financially literate? The way we see it, it all starts with educating yourself on the key concepts. And free courses are a way to do just that.

More High Schools Are Requiring Personal Finance Courses

Though the statistics about Americans and their levels of financial literacy are promising, a large percentage of the U.S. population still lacks the skills necessary to master their finances. For this reason, more and more high schools are offering finance courses as an elective. Roughly 30 states across the country have implemented mandates requiring schools to offer personal finance education at the high school level.

However, it is important to note that not all of these states enforce the inclusion of personal finance courses as a graduation requirement. Only 17 states have made these courses a requirement to earn that diploma. While the recognition of financial literacy's significance is commendable, the absence of a mandatory course undermines the potential impact of these initiatives.

Growing Your Financial Literacy with the Financial Skills That All Americans Need to Know

Whether you have taken a personal finance course or have learned some important tips along the way, one thing is for certain—personal finance skills are a must. In the least, acquiring the following skills can pay off in divends, literally and figuratively, over the years.

- Basic Budgeting: Understanding and implementing a family budget, or even a budget for singles, helps individuals track their income and expenses, making sure they know where their money is coming from and where it's going.

- Bank Account 101: As more and more things go digital and paper checks and manual check registries are rare, it is so important for members of Generation Z to grasp basic banking fundamentals, including comprehension of minimum balance requirements, the implications of being overdrawn, knowledge of overdraft and service fees, and the ability to access and manage all relevant account information.

- Wants vs. Needs: Understanding the distinction between financial needs and wants is a super important part of financial literacy, especially for young individuals who are venturing out on their own for the first time. Your needs include the basic elements required to sustain our daily lives, while everything else falls into the category of wants, regardless of our perception of their necessity.

- Saving & Investing: While it may be unrealistic to expect a newly independent adult to have a fully funded emergency savings account immediately, it is necessary for them to grasp the importance of saving and investing, specifically for genuine emergencies such as job loss, significant car repairs, or unexpected medical expenses, and begin allocating funds accordingly.

- Credit Scores: Understanding your credit score is non-negotiable because it significantly determines your eligibility for loans, credit cards, and favorable interest rates. A good credit score can open doors to better financial opportunities, while a poor credit score can limit your access to credit and result in higher borrowing costs.

- Financial Terms: Possessing a basic financial vocabulary is also a big part of financial literacy as it equips you with the knowledge to make informed decisions about personal finance matters. Understanding terms such as budget, interest, loans, equity, and more empowers you to confidently develop and implement your own effective financial strategy tailored to your goals.

- When to Seek Help: Nonprofit credit counseling agencies provide financial guidance, often with free assistance, regardless of your financial circumstances, making them a valuable resource to consider when facing challenges such as job loss and budgeting difficulties or when exploring debt repayment options. Whether seeking local or remote assistance, these agencies offer general personal finance advice and homeownership counseling.

Improving Your Financial Literacy with Free Personal Finances Classes

Americans can pave the way for a brighter financial future by taking charge of their financial knowledge, understanding both the fundamental and intricate concepts that underpin personal finance, and building their financial literacy. From budgeting and saving to investing and retirement planning, gaining proficiency in these areas is a must for making informed financial decisions.

Fortunately, you don’t have to go back to high school to gain these imperative life skills. There are numerous free personal finance classes available that cater to individuals at various stages of their financial journey. Whether you are starting from scratch or looking to grow your existing knowledge, these classes offer a valuable opportunity to expand your financial literacy and empower yourself to take control of your economic well-being.

By taking advantage of these resources, you can develop the skills and expertise necessary to manage the complex world of personal finance with confidence and pave the way toward a more prosperous future.

- Finance for Everyone: Smart Tools for Decision-Making: An online course offered on edX that provides learners with practical tools and knowledge to make informed financial decisions in areas such as budgeting, investing, and risk management.

- McGill Personal Finance Essentials: A comprehensive range of courses designed to build individuals' financial literacy and decision-making skills. With topics covering budgeting, investing, debt management, and retirement planning, these courses provide practical knowledge and strategies to empower learners in achieving their financial goals.

- Brigham Young University's personal finance courses: These courses provide students with a solid foundation in financial management, covering topics such as budgeting, saving, investing, and managing debt. These courses aim to equip learners with essential skills and knowledge to make informed financial decisions and achieve long-term financial success.

- Udemy.com's Personal Finance 101: This course provides a comprehensive understanding of personal finance fundamentals, including budgeting, saving, investing, and managing debt. By completing this course, students gain practical skills and knowledge to take control of their financial lives, make informed decisions, and work towards achieving their financial goals.

- Purdue University's Planning for a Secure Retirement: The primary goal of this course is to assist individuals in their retirement planning journey. Through ten comprehensive modules, the course offers valuable insights, addressing big questions and providing actionable information to help individuals make informed decisions. Each module incorporates specific goals, interactive activities, and additional resources to further support learners in their quest for a well-prepared retirement.

- Duke University's Behavioral Finance Course: This class explores the intersection of psychology and finance, providing an in-depth understanding of how human behavior influences financial decision-making. Learners will delve into topics such as cognitive biases, investment behavior, market efficiency, and the impact of emotions on financial choices, gaining valuable insights into the psychological factors that shape financial outcomes.

- The University of Illinois—Urbana-Champaign's Financial Planning for Young Adults: Here, you will learn essential topics for creating comprehensive financial plans. Learners will explore areas such as goal setting, budgeting, tax planning, investment strategies, retirement planning, and risk management, equipping them with the knowledge and skills to develop effective financial plans that align with their long-term objectives.

- Alison.com's Introduction to Managing Your Personal Finance Debts: In this complimentary online course focused on personal debt management, you will gain valuable insights into effective debt management practices and receive practical tips for alleviating and controlling your personal financial debts. As life presents unexpected financial challenges, individuals frequently resort to taking out loans, which can accumulate and eventually become overwhelming.

- Marginal Revolution University's Money Skills: This free course teaches participants essential financial skills and concepts, including budgeting, saving, investing, understanding credit, and making informed financial decisions to achieve greater financial well-being.

- Khan Academy's personal finance classes: Participants can expect to gain a comprehensive understanding of personal finance topics and acquire practical skills to make informed financial decisions through the courses offered on Khan Academy. These courses cover a wide range of areas such as budgeting, saving, investing, taxes, and insurance, providing learners with the knowledge and confidence to manage their personal finances and achieve long-term financial success.

- NAFSA's Financial Literacy Program: The free finance courses offered on NAFSA’s website provide learners with valuable financial knowledge and skills to make informed decisions about money management, budgeting, credit, and investing.

- Planning for Risk, Retirement, and Investment: Participants can expect to gain valuable insights and practical strategies for planning their risk management and retirement, equipping them with the knowledge and tools to make informed decisions for a secure financial future.

- Work Smarter, Not Harder: Time Management for Personal & Professional Productivity: This course provides valuable insights and practical techniques to improve productivity and efficiency in the workplace. By exploring concepts such as time management, prioritization, delegation, and effective communication, participants can expect to develop strategies that optimize their work habits and achieve better results with less effort.

Gaining Financial Literacy With Free Courses Can Help You Better Manage Your Personal Finances

In today's complex financial landscape, acquiring financial literacy has never been more important. Understanding the fundamentals of personal finance empowers individuals to make informed decisions, take control of their financial well-being, and work towards achieving their goals. With the availability of free personal finance courses mentioned above.

By enrolling in these courses, readers can equip themselves with the necessary tools and insights to understanding budgeting, debt management, investing, retirement planning, and other key aspects of personal finance. Taking the initiative to educate oneself through these free resources can lead to better financial outcomes and improved overall financial health.

Don't hesitate to set yourself on the path to financial literacy by exploring these free courses and gaining valuable tips for managing your personal finances. Your financial future awaits your proactive engagement and empowerment.