How to Ask for a Raise

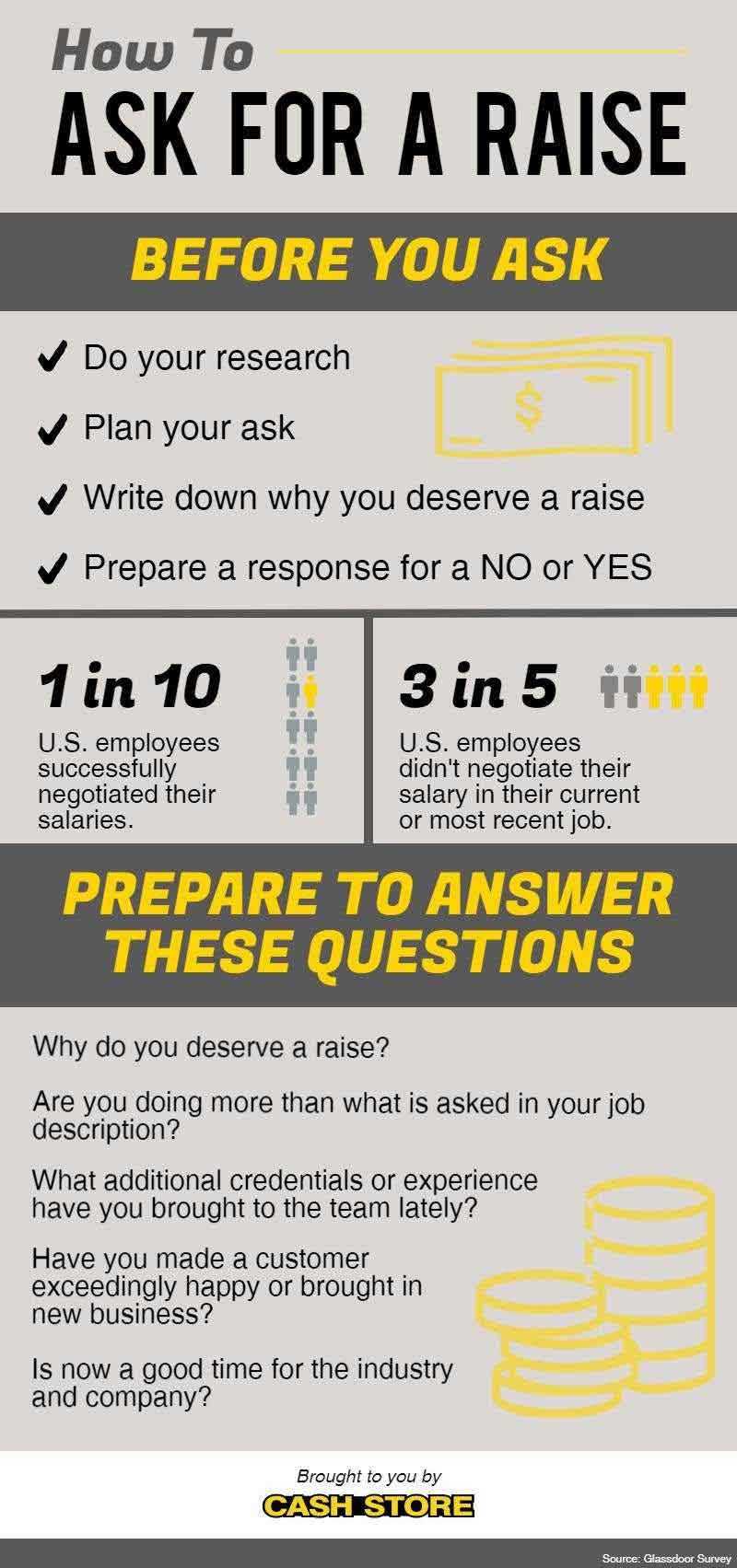

Are you earning the right salary? Feeling properly compensated for your efforts can drastically improve work satisfaction. However, many people are afraid to broach this topic with their employers. In fact, Salary.com found that one-fifth of people never negotiate their salaries.

If the idea of approaching your employer about a raise makes your anxious, consider why. Is it because you are nervous anticipating an awkward conversation? Or, is it because the timing isn't right?

Ask Yourself These Questions Before Your Boss Does

If you aren't prepared to answer your boss's probing questions, work on practicing your answers to avoid a potentially awkward scenario. You should be ready to answer the following questions:

- Why do you deserve a raise?

- Are you doing more than what is asked in your job description?

- What added credentials or experience have you brought to the team lately?

- Have you made a customer exceedingly happy or brought in new business?

- Is now a good time for the industry and company?

If you are new to the company, or if there is a negative industry trend, it's best to wait before you ask your boss. However, if you think the company is in good standing and you truly deserve a higher compensation for your efforts, summon up the courage and make the ask confidently.

To-Do List Before You Ask for a Raise

Do Your Research

Don't go to your boss blindly. Know key statistics to give yourself confidence in the ask. This is not so you can spout out numbers arrogantly, but so you can make an informed request. Be aware of things like the local salary averages for your industry and experience level. There are many tools online, like this one from Salary.com, which can help you see general salaries for an occupation and takes location into consideration.

Plan Your Ask

There are definite wrong ways and right ways to ask for a raise. Never enter a salary negotiation conversation for any of the following reasons:

- You've been with the company for a long time

- You haven't had one in a year

- You know how much a coworker makes

These points don't warrant a raise and are not appealing to managers. You should never ask for a raise solely because you're in a financially tough spot. Employers aren't willing to pay you more because your rent increased or because your dog got sick. They are more likely to reward you for your increased workload or additional skills earned.

Record and Rehearse Why You Deserve a Raise

It's important to have reasons to back up why you deserve a raise. Keep track of any additional time and effort put into your role that isn't part of your job description. If you are simply doing a good job in the necessary parts of your job, you don't have much ground to stand on. Make detailed notes of the times you go above and beyond, bring in business, or make a customer exceedingly happy. Rehearse these valid points before you ask your boss.

Consider the Factors

Knowing the industry average is helpful, but there are many reasons why one salary could be different than another in the same position. If you are lower on the spectrum, think about ways you could increase your changes for a raise. Could you be specializing further within an industry niche or getting involved in something the company cares about?

Another smart idea? Ask the boss to put more on your plate. Erin Greenawald, freelance writer, editor, and content strategist, shares this advice and explains how the employees who take initiative are the ones she'd like to promote.

Prepare for a No

While I'm more of a positive thinker, it can be good to prepare for the word 'No.' Know how you will react to a negative response and know where to lead the conversation after it. You don't have to stop at a salary - consider asking for more vacation time, a bonus, a professional development course, or another form of compensation.

Know How Much Money You Want

One of the best possibilities is your boss simply saying yes and asking how much money you want. It's imperative that you have a number in mind and can confidently tell your boss what you're seeking to earn.

Asking for a raise can be uncomfortable, but it's a necessary conversation to have if you feel like you're being under-compensated. Even if your boss says no initially, starting the conversation can give you a better idea of how and when you might earn one in the future. If you don't ask, you will start to feel underappreciated, and you don't want to become negative Nancy. Nancy never gets raises.

Looking for more counsel on your career? Read more posts in our career advice section.

More Articles

What to Know About Crypto-Backed Loans

Curious about using your crypto as collateral? Discover how crypto-backed loans work, their benefits, risks, and what to consider before borrowing.

Read More >How Does Installment Loan Approval Work?

Curious about how installment loan approval works? Learn about the key factors lenders consider, the application process, and tips to improve your chances of approval.

Read More >Is it Better to Get an Installment Loan or Line of Credit?

Installment loan or line of credit—which is right for you? Learn the key differences, pros and cons, and how to choose the best option for your financial needs.

Read More >Loan Amount is subject to loan approval. Loan terms and availability may vary by location. Approval rate based on complete applications received across all Cash Store locations. Customers can typically expect to receive loan proceeds in less than 20 minutes; however, processing times may vary. Loans / Advances are provided based on approved credit. Each applicant for credit is evaluated for creditworthiness.

Please see the Licenses and Rates page for additional product details.

Cash Store offers consumer credit products that are generally short-term in nature and not intended for long-term borrowing needs.

In Texas, Cash Store is a Credit Services Organization. Loans are provided by a non-affiliated third-party lender. Please see the Licenses and Rates page for links to Consumer Disclosures and choose the one for the product and amount that most closely relates to your loan request.

Customer Portal residency restrictions apply. Availability of funds may vary by financial institution.