Online Tools to Help You Pay off Debt

It’s hard for some of us to imagine a world where we are completely debt-free, but not only is it possible... it’s liberating. Paying off your debts is more than just setting aside money every month—it’s about knowing how much you need to pay back and how long you have to do so. It’s important to make a plan before more interest accrues and you find yourself in a seemingly impossible place to get above water again. There is specific mathematics to paying off loans and earning that financial liberation, so we've compiled the following tools to help do most of the math for you.

Dave Ramsey’s EveryDollar Tool

Cost: Free or $8.25 per month

Dave Ramsey is a money guru and a big supporter of the “debt snowball method.” A lot of people seem to think that paying off their largest loan with the highest interest rate first will help them save enough money to pay off smaller loans and debts, but the snowball method actually dictates the opposite. Using this method, you:

- Pay off your smallest loan first

- Track your progress, and

- Work your way up from there

The morale boost that comes from seeing your progress evolve early and often can help mentally motivate you to keep going, instead of getting demoralized while looking up at your largest debt and knowing there are even more that will be following it.

The tool itself offers you a “consultation” of sorts for free. You enter all your information, and the app will give you a big picture layout of where and how to begin. From there, you can choose to keep it free and just take your own notes or pay the membership fee to join the EveryDollar Plus program. Joining the program will allow you to visualize all your debts and it will generate graphs that will track your progress.

If you opt for the membership, you can also use its algorithm to generate a countdown to being totally debt-free, and it will even create a payment schedule for you. You can add or postpone extra payments as you see fit, and even have the schedule fully automate itself.

Cost: Free

Mint is an all-encompassing money app and website that offers financial help with anything from budgeting, credit score management, bill tracking, and even investment advice. There is also a built-in “Goals” function that allows you to set money-saving objectives and then use that leftover money to repay your debts in larger payments.

Similar to the Dave Ramsey tool, it can also help you set a hard deadline to have a certain amount of money saved up, and it will adjust your daily budget accordingly all by itself. Mint can tell you exactly how long it would take for you to get yourself out of debt based on all your minimum payments (usually way too long) and then simulate how long it would take based on making slightly higher payments. You’d be surprised at how many months or even years that an extra $15-$20 per month could shave off.

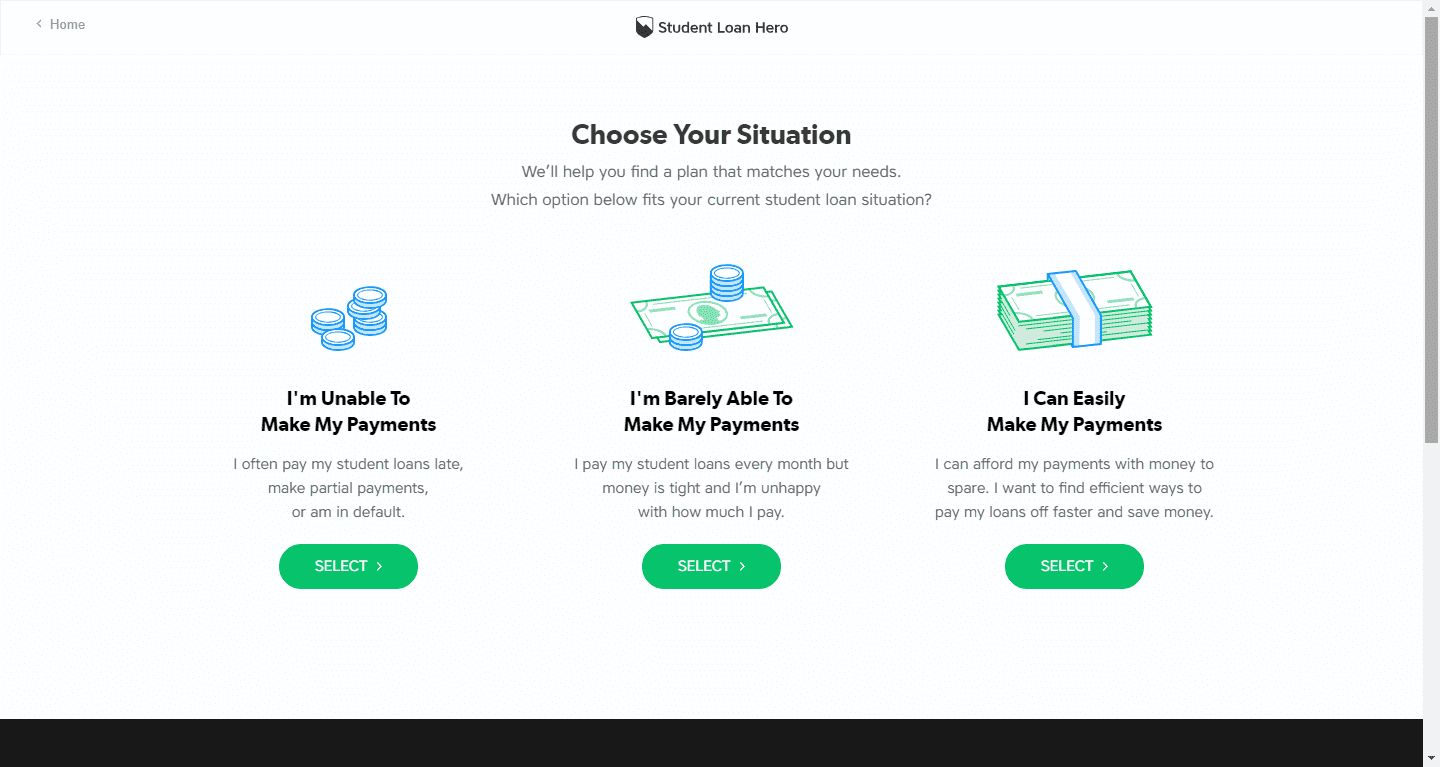

Student Loan Hero

Cost: Free

Over 44 million Americans are in some sort of student loan debt, so you’re certainly not alone in this boat. It takes an average college graduate to pay off their debt and for some, that number is even larger.

The Student Loan Hero Dashboard is a very clean, minimalistic tool that you can access for free. It’s built specifically for student loans, so it’s very easy to navigate and sync all your student loans across all the different institutions that have financed you. Student loans frequently get sold to collection agencies and it can sometimes be hard to keep up with who you are actually supposed to be paying, how much, etc. Luckily, the SLH Dashboard keeps accurate records regarding who owns your debt and how much your minimum payments are.

Like some of the other apps, you can also forecast a future of student loan freedom based on how you want to tweak your payment amounts and frequency, and it also allows you to get signed up for federal payment plans. If you feel like you need to take a break for a few months, instead of calling a loan office or collections agency and being placed on hold for hours, you can use the SLH Dashboard to place your loans in forbearance or deferment.

If you need more money-saving tips and ways you can live on a budget while pulling yourself out of debt, !

More Articles

What to Know About Crypto-Backed Loans

Curious about using your crypto as collateral? Discover how crypto-backed loans work, their benefits, risks, and what to consider before borrowing.

Read More >How Does Installment Loan Approval Work?

Curious about how installment loan approval works? Learn about the key factors lenders consider, the application process, and tips to improve your chances of approval.

Read More >Is it Better to Get an Installment Loan or Line of Credit?

Installment loan or line of credit—which is right for you? Learn the key differences, pros and cons, and how to choose the best option for your financial needs.

Read More >Loan Amount is subject to loan approval. Loan terms and availability may vary by location. Approval rate based on complete applications received across all Cash Store locations. Customers can typically expect to receive loan proceeds in less than 20 minutes; however, processing times may vary. Loans / Advances are provided based on approved credit. Each applicant for credit is evaluated for creditworthiness.

Please see the Licenses and Rates page for additional product details.

Cash Store offers consumer credit products that are generally short-term in nature and not intended for long-term borrowing needs.

In Texas, Cash Store is a Credit Services Organization. Loans are provided by a non-affiliated third-party lender. Please see the Licenses and Rates page for links to Consumer Disclosures and choose the one for the product and amount that most closely relates to your loan request.

Customer Portal residency restrictions apply. Availability of funds may vary by financial institution.