Cash Store Blog

Creating a Financial Vision Board: Manifesting Your Financial Goals for Success

In the quest for financial success, only about a quarter of those aiming to buy a house or secure a better-paying job find triumph. Shockingly, 18% of Americans haven't checked off any financial goals this year. As 2023 winds down, 42% lack confidence in reaching their goals by January 1.

Enter the financial vision board—an empowering tool to visualize and materialize success. Harness the potency of visualization to craft a roadmap for 2024, propelling yourself toward accomplishing your financial aspirations.

Understanding Financial Vision Boards

The human brain is a visual powerhouse, processing images 60,000 times faster than text. Astonishingly, people remember 65% of what they see, compared to a mere 10% of what they hear. This unique trait makes visual aids, like financial vision boards, powerful tools for achieving goals. When you have a visual representation of your aspirations, it's more likely to grab your attention and stay embedded in your memory.

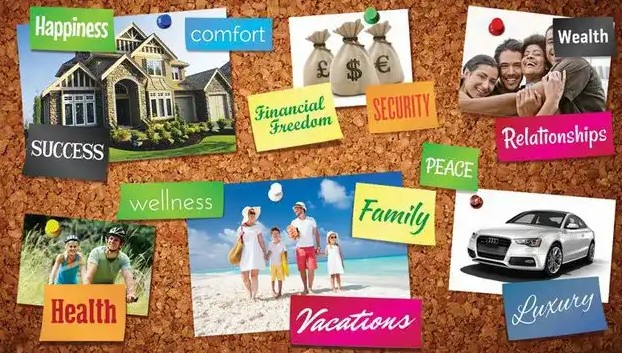

A vision board is essentially a collage of images that symbolize your dreams and goals. It can include pictures cut from magazines and motivational words to inspire you along your journey. While research on the effectiveness of vision boards is limited, initial findings suggest that they can be instrumental in helping individuals achieve their goals. Vision boards foster self-awareness and prompt self-reflection, guiding us toward what truly matters.

Moreover, these boards aid in envisioning a positive future, fostering optimism and positive emotions. This optimistic mindset often opens doors to opportunities and increases the likelihood of success. In the financial space, a money-focused version can be just the ticket—the financial vision board. It's a curated collection of images linked to personal life goals, organized by the required investment of money and time.

Creating a financial vision board bridges the mental gap between your current financial status and your aspirations. This tangible visualization serves as a roadmap, bringing your financial goals into focus and motivating you to turn dreams into reality.

Setting Financial Goals and Objectives

Financial goal visualization is the compass that directs your monetary journey. To navigate this path effectively, employ the proven strategy of setting specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. Clarity and precision in goal-setting are the keys to turning aspirations into attainable realities.

A financial goal is essentially a plan for your money, encompassing both short-term and long-term objectives. Short-term financial goals involve immediate targets, such as saving up for emergencies, funding a vacation, or purchasing a new kitchen appliance.

Mid-term goals may include preparing for an upcoming semester's school expenses, saving for an engagement ring, or putting down a deposit on an apartment lease. These goals provide a roadmap for saving and spending with purpose, reflecting your commitments to the life you envision.

Long-term financial goals require a broader perspective, including ambitions like buying a new car outright, funding your child's college education, saving for retirement, launching a business, or indulging in extensive travel. Each objective represents a significant life milestone, and financial goal-setting ensures you're strategically planning your financial resources to realize these dreams.

You proactively shape your financial destiny by incorporating financial goal-setting into every facet of your life. Be it the joy of purchasing birthday gifts or the foresight to save for a house down payment, each goal, short or long-term, contributes to a financially fulfilling journey. With SMART financial goals, you chart a clear course and equip yourself with the tools to transform visions into tangible achievements.

Selecting Visual Elements for Your Vision Board

Visualizing financial goals is a crucial step toward turning dreams into reality, and creating a money vision board is a powerful tool in this journey. Selecting the right visual elements—images, quotes, symbols, or representations—is key to crafting a vision board that resonates with your aspirations.

The goal is to choose elements that evoke strong emotional connections, reinforcing your commitment to achieving financial success.

Images of Financial Milestones

- Pictures of a dream house, car, or vacation destination.

- Photos showing credit cards with a $0 balance.

- Imagery representing debt-free living or financial independence.

Quotes and Affirmations

- Inspirational quotes about financial success.

- Personal affirmations reinforcing your commitment to financial goals.

Symbols of Prosperity

- Icons representing wealth, such as coins, dollar signs, or a flourishing tree.

- Photos that demonstrate retirement, such as a beach house or vacation home.

- Symbols specific to your cultural or personal understanding of prosperity.

Representations of Financial Freedom

- Images capturing the essence of financial freedom, like open road vistas or images of a peaceful retirement.

Visuals Reflecting Savings and Investments

- Pictures of a piggy bank or stacks of coins symbolizing savings.

- Graphics representing diverse investment opportunities.

Online Resources for Visuals

- Pinterest: With over 200,000 pins, Pinterest can inspire ample inspiration.

- Unsplash and Pexels: Platforms offering high-quality, free-to-use images.

- Finance Websites: Explore financial news sites for relevant images and infographics.

- Custom Graphics Apps: Create personalized symbols or representations using graphic design apps.

Remember, the visual elements on your vision board should represent financial goals and evoke a deep emotional connection. The more emotionally invested you are in your vision board, the more powerful and effective it becomes in steering your financial journey.

Assembling and Designing Your Financial Vision Board

It's time to manifest financial success and turn your aspirations into tangible goals by creating a vision board. Whether you opt for scissors and glue or your favorite design app, follow these four steps to organize your process.

1. Start With Your Theme

Define a specific objective for your vision board—a financial vision board. Focus on one clear theme rather than overwhelming yourself with random ideas. Creating a board for each goal allows for a more focused and organized approach.

2. Collect Images

For a physical board, clip images from magazines or print from the internet, based on our suggestions above. If digital, use Pinterest or stock photo libraries. Broadly collect images that resonate with your goals, even if they initially seem unrelated. These visuals may spark new ideas and aspirations.

3. Construct Your Financial Aspirations Collage

Arrange your images intuitively, focusing on a layout that appeals to you. There's no right way to do it—trust your instincts. Add motivational and informative text if desired. The goal is to create a visually compelling representation of your financial dreams.

4. Keep the Vision Board Close and In Your View

Your vision board is a powerful tool, but it's just the beginning. As you take action toward your financial goals, revisit your board for motivation. Display it prominently on your desk, as a computer screen background (if digital), or on your refrigerator. Let it serve as a daily reminder and source of inspiration.

Feel free to relocate your vision board as needed. Whether by your bedside or next to the bathroom mirror, let it evolve with you as you progress toward manifesting your financial success.

Want to Create a Digital Vision Board?

Consider crafting a digital version of your financial vision board in the spirit of environmental consciousness and cost-effectiveness. This approach reduces paper usage and provides a convenient and accessible solution. To ensure easy access, consider printing it out or finding a digital platform that suits your needs.

One valuable tool for this process is Canva, a user-friendly design platform. Canva's vision board maker simplifies the design process with an extensive library of editable templates and design elements. Start from scratch or choose a pre-made template, customizing it with free graphics, vectors, illustrations, icons, and more.

Download and print your digital creation to display on your bedroom wall or set it as your device's wallpaper, ensuring your financial goals remain a constant visual presence in your daily life. Whether earning your first million or traveling to your dream destination, let Canva help bring your aspirations to life.

Utilizing the Financial Vision Board Effectively

Your money vision board is more than just pictures – it's a tool you actively use for financial success. Here are simple ways to get the most out of it:

- Look Every Day: Take a few minutes to review your board. Imagine reaching those goals. This daily practice keeps your focus sharp and reminds you of your commitment.

- Say Positive Things: Along with looking, say positive things about your goals. Speak confidently about your ability to achieve them. This helps build belief in yourself.

- Check Your Progress: Keep an eye on how you're doing. Use your board as a guide. Celebrate small wins and adjust your goals as needed.

- Share Your Goals: Talk about your money goals with someone you trust. It gives you support and makes you more accountable.

- Think, Adjust, Grow: Reflect on your board regularly. Adjust goals when things change. Your vision board should be flexible and grow with you.

By using your money vision board every day through simple practices like looking, speaking positively, tracking progress, and sharing goals, you turn it into a tool that actively helps you achieve your financial dreams.

Long-Term Benefits and Reviewing Your Vision Board

Consistently revisiting your financial vision board brings about enduring advantages, shaping not just your financial path but your overall life journey. Here's why maintaining and regularly reviewing your vision board is a valuable practice:

- Get Clear on Goals: A financial vision board acts as a compass, helping you articulate and refine your life goals. Regularly reviewing it ensures you stay focused and connected to your aspirations.

- Helps You Grow: The process of maintaining and revisiting your vision board is a journey of personal growth. It prompts self-awareness, encouraging you to evolve and adapt as your goals and circumstances change.

- Get Motivated: Your vision board is a wellspring of motivation. Regularly immersing yourself in the visual representation of your dreams keeps you inspired, making it easier to stay committed to your financial objectives.

- Shift Your Mindset: Over time, consistently reviewing your vision board transforms your mindset. It instills a positive outlook, fostering confidence in your ability to overcome financial challenges and achieve success.

- Be Intentional: The intentional act of revisiting your vision board reinforces your commitment to your financial journey. It's a reminder that every financial decision aligns with your long-term goals.

- Feel Happy: A vision board serves as a source of joy. Regular engagement with positive images and affirmations brings happiness and fulfillment, adding a sense of purpose to your financial endeavors.

- Connect to Areas of Your Life: Beyond finances, a vision board connects you to various aspects of your life, creating a holistic approach to goal-setting and achievement.

- Master Your Finances: Through long-term financial visualization, you master your finances. It becomes a tool for setting goals and strategically navigating the intricacies of your financial journey.

Your vision board is a practical visualization tool, aiding you in translating dreams into actionable steps. Regular reviews refine your focus, ensuring your actions align with your financial vision.

Emphasize the importance of adjusting goals as circumstances change and celebrating achievements. The financial vision board is not static; it's a dynamic tool that grows with you, guiding you toward enduring success in your financial pursuits.

Visualizing Financial Success with Your Vision Board

The financial vision board is a pivotal tool, steering individuals toward their aspirations with purpose and clarity. As only about a quarter of those aiming for financial milestones succeed, the importance of goal-setting for finances is evident. The financial vision board provides a tangible roadmap, leveraging the power of visualization to manifest dreams into reality.

By actively engaging in creating and utilizing a financial vision board, individuals can gain clarity on their goals, foster motivation, and shift their mindset towards achievement. It is a dynamic tool that not only aids in goal-setting for finances but also promotes personal growth, intentionality, and happiness throughout the journey.

Encouraging readers to embark on their financial visualization journey, creating their financial vision boards becomes not just a suggestion but a transformative call to action. Visualize your goals, make them real, and celebrate your financial victories along the way.

Stay connected with the Cash Store blog for ongoing guidance and insightful tips. Here, you'll find a wealth of resources to enhance your financial knowledge further and keep you on the path to achieving your aspirations. Start your financial vision board today, and let it become the compass guiding you toward the financial success you envision.