How to Manage Your Credit with Cash Store

Once we turn 18, consumers in the United States can start building their credit. This means applying for a first credit card or loan, not only to borrow some money to finance a purchase but to help you make payments on time and master your finances. But unfortunately, good financial advice on how to manage your credit isn’t always forthcoming. In most cases, you must do your homework to understand best what good money management is. At Cash Store, we don’t want consumers to have to work so hard to learn what it takes to manage credit effectively. So we’ve put together some helpful insights to set you on a path towards a good credit score balanced with living within your means.

Understanding Your Credit Score to Help Manage Your Credit

A good way to think about managing your credit is to revisit how your credit score is calculated in the first place and how that score translates into good, bad, and everywhere in between. Let’s start with how your credit score is calculated. Though there are two primary scoring models, FICO and VantageScore, we’ll use the FICO score for this article.

Your FICO score is calculated using five factors.

- Payment history, 35%

- Amounts owed, 30%

- Length of credit history, 15%

- New credit, 10%

- Credit mix, 10%

And, all of this information is used to group your score into one of the following credit score ranges.

| Excellent | 800 to 850 |

| Very Good | 740 to 799 |

| Good | 670 to 739 |

| Fair | 580 to 669 |

| Poor | 300 to 579 |

It might be helpful for you to know that the average credit score in the U.S. is 714, and has been for quite some time. As you can see, a 714 credit score falls neatly within the good range as described by FICO. Consumers with good credit scores often have an easier time getting lower rates and terms on personal loans, credit cards, mortgages, and more.

Tips to Manage Your Credit and How Cash Store Can Help

If your credit score falls below the national average of 714, we recommend trying to improve your score to that or higher. And while it won’t happen overnight, there are some things you can do to manage your credit and take baby steps in improving your score.

1. Know your credit score

Your credit score is a crucial factor in determining your financial health. You can obtain a free credit report from each of the three major credit bureaus (Experian, Equifax, and TransUnion) or via AnnualCreditReport.com once a year, which can help you understand where you stand financially. Keeping an eye on your credit score can also help you identify any errors or fraudulent activity on your credit report.

2. Make timely payments

Late payments can negatively impact your credit score by up to 180 points, so making payments on time is crucial. See if your creditor offers automatic payments to ensure you don’t miss any. And if you are late on a payment, do whatever you can to make it up as soon as possible.

3. Keep credit utilization low

Your credit utilization ratio is the amount of credit you use compared to the amount available. Keeping your credit utilization ratio low (ideally under 30%) can help improve your credit score.

4. Use credit responsibly

Using credit responsibly means borrowing money you can afford to repay without negatively impacting your financial stability. Creating a family budget with the 50/20/30 methodology can help you live within your means, avoid overspending, and steadily pay off any outstanding debts. The 50/20/30 rule suggests you allocate 50% of your income towards essential expenses, 20% towards savings and debt repayment, and 30% towards discretionary expenses. By dedicating 20% of your income to debt repayment, you can progress toward paying off any outstanding debts and avoid maxing out your credit cards or taking out loans you can't afford to repay.

5. Consider Cash Store for short-term loans

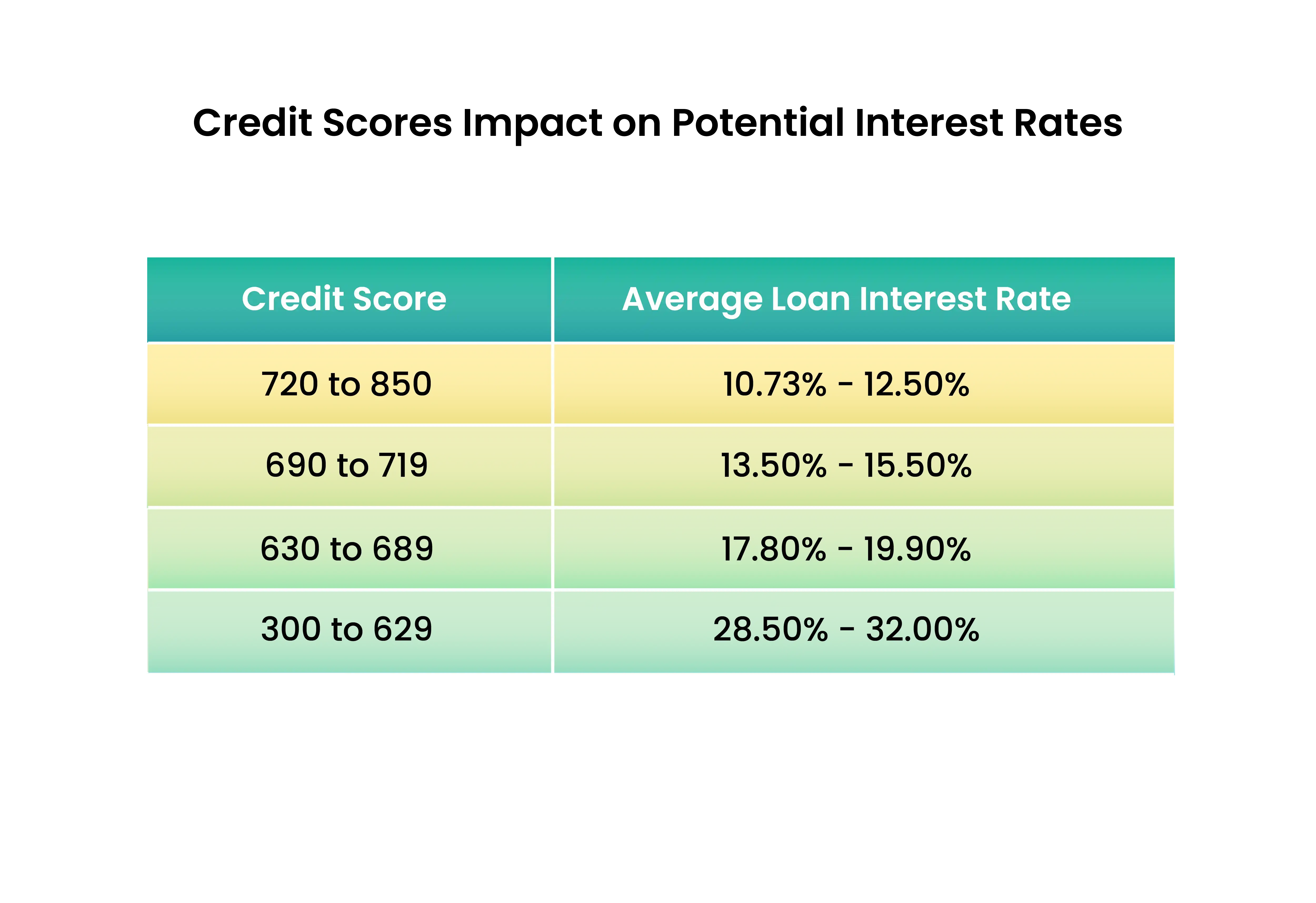

If your credit score falls into one of the fair to bad ranges, you might not be eligible for the best loan terms. So, while you are working to manage your credit, a Cash Store loan can help with your short-term needs. At Cash Store, we offer installment loans and title loans, which can be a good option if you need money quickly.

Cash Store is here to help

Learning how to manage credit is essential to your financial health, and using credit responsibly can help you achieve your financial goals. Whether you need a short-term loan to cover unexpected expenses or want to improve your credit score, Cash Store is here to help. With installment and title loans available, you can quickly and easily get the money you need.

Remember, it's essential to read the terms and conditions carefully and only borrow what you can afford to repay. Contact Cash Store today to learn more about how we can help you manage your credit and achieve your financial goals.

*The content on this page provides general consumer information or tips. It is not financial advice or guidance. Each person’s circumstances are unique. The Cash Store may update this information periodically. This information may also include links or references to third-party resources or content. We do not endorse the third-party or guarantee the accuracy of this third-party information. There may be other resources that also serve your needs.

More Articles

What to Know About Crypto-Backed Loans

Curious about using your crypto as collateral? Discover how crypto-backed loans work, their benefits, risks, and what to consider before borrowing.

Read More >How Does Installment Loan Approval Work?

Curious about how installment loan approval works? Learn about the key factors lenders consider, the application process, and tips to improve your chances of approval.

Read More >Is it Better to Get an Installment Loan or Line of Credit?

Installment loan or line of credit—which is right for you? Learn the key differences, pros and cons, and how to choose the best option for your financial needs.

Read More >Loan Amount is subject to loan approval. Loan terms and availability may vary by location. Approval rate based on complete applications received across all Cash Store locations. Customers can typically expect to receive loan proceeds in less than 20 minutes; however, processing times may vary. Loans / Advances are provided based on approved credit. Each applicant for credit is evaluated for creditworthiness.

Please see the Licenses and Rates page for additional product details.

Cash Store offers consumer credit products that are generally short-term in nature and not intended for long-term borrowing needs.

In Texas, Cash Store is a Credit Services Organization. Loans are provided by a non-affiliated third-party lender. Please see the Licenses and Rates page for links to Consumer Disclosures and choose the one for the product and amount that most closely relates to your loan request.

Customer Portal residency restrictions apply. Availability of funds may vary by financial institution.