Real Estate Market Updates: Insights, Trends, and Strategies

It seems like the real estate landscape is in a constant state of change. And, staying informed is key. Understanding the dynamic trends is crucial whether you're in the market to buy or sell a house. The ebb and flow of real estate activity significantly impacts your ability to make successful offers or find buyers swiftly.

Moreover, it can influence how lenders assess property value during the closing process. This blog dives into the latest real estate market trends, housing updates, property analyses, and essential statistics so that you can make well-informed decisions in your real estate ventures.

Current Trends in the Real Estate Market

The real estate landscape is undergoing transformative shifts, influenced by various factors that shape housing market trends. One prominent driver is the ongoing relocation from big cities to suburban areas—an existing trend accelerated by the COVID-19 pandemic.

- Virtual House Hunting Persists: House hunting has transitioned and remained predominantly virtual despite the pandemic waning. This shift offers convenience and flexibility for buyers, allowing them to explore properties remotely.

- Suburban Migration: A significant trend is the migration from urban centers to the suburbs. Cities like New York, San Francisco, and Washington, DC, are expected to rebound post-pandemic, but the preference for suburban living may persist for the next 3-5 years.

- Necessity and Choice: The shift from big city living is driven by necessity and choice. Individuals facing job loss and unaffordable urban prices are compelled to relocate, while wealthier individuals choose to move for lifestyle preferences.

- Sun Belt Popularity: The Sun Belt has become a favored destination amid this shift, reinforced by the pandemic. The trend toward this region will likely continue, driven by climate, cost of living, and lifestyle offerings.

- Growing Demand for Single-Family Homes: As people move to the suburbs, there is a growing demand for single-family homes. This shift in preference is reshaping the real estate market, emphasizing the appeal of more spacious and independent living arrangements.

- Low Inventory Challenges: Despite the growing demand, there is a persistent issue of low inventory. Buyers need to act swiftly, as desirable homes are snapped up quickly. In September 2023, homes spent an average of 48 days on the market, reflecting a sense of urgency in the current real estate climate.

- Continuous Home Price Growth: Home prices continue to rise, albeit at a moderated pace. In September 2023, the national median home price reached $429,500, showing a 0.41% growth compared to the same month in 2022. This sustained growth reflects the resilience of the real estate market.

Staying abreast of these trends is vital for anyone navigating the real estate market, ensuring informed decision-making in a landscape shaped by evolving preferences and external influences.

Analysis of Property Market Data

Understanding the nuances of property market data is essential for making informed real estate decisions. Recent statistics shed light on crucial aspects, revealing trends and patterns in the market.

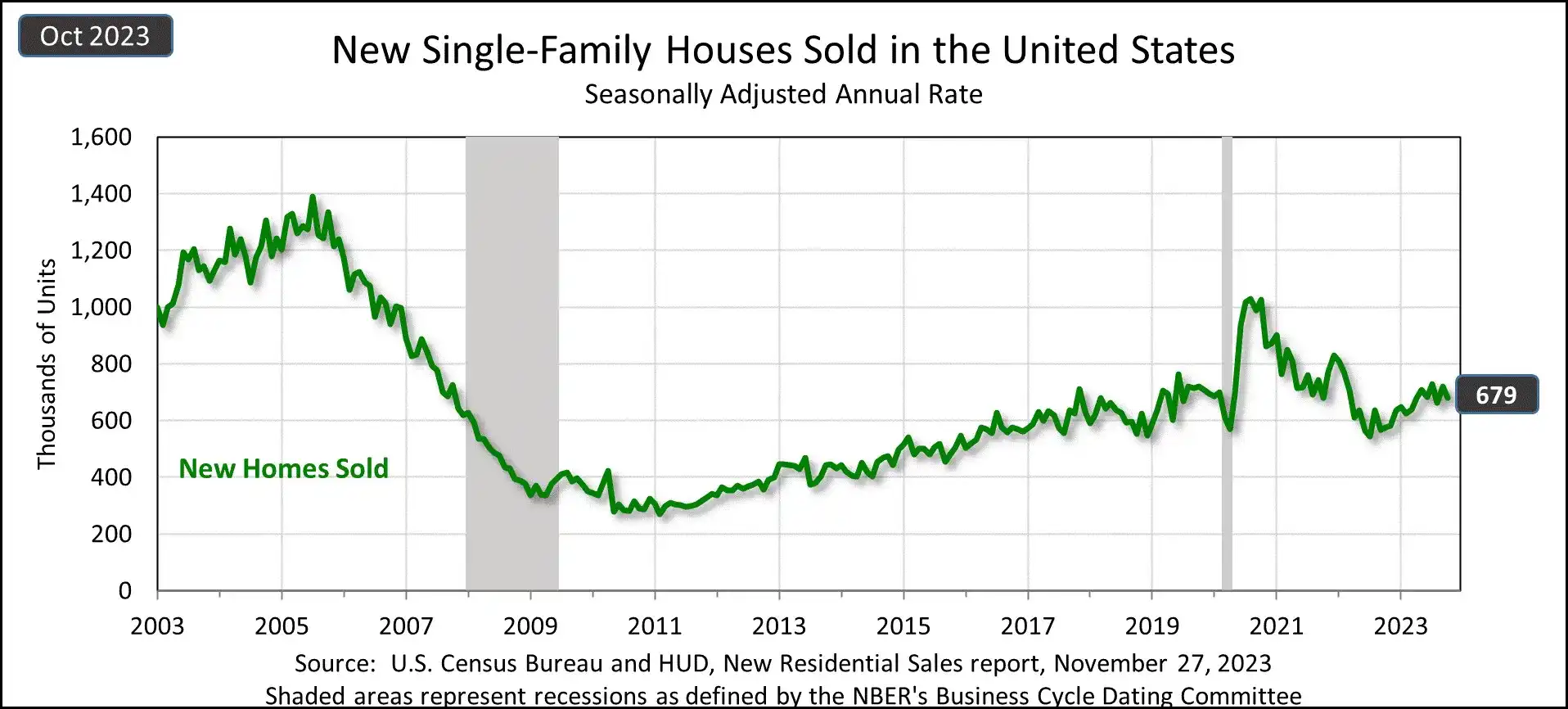

According to the U.S. Census Bureau, new single-family home sales in October 2023 reached a seasonally adjusted annual rate of 679,000. This reflects a 5.6% decrease from September but a notable 17.7% increase from October 2022, emphasizing the dynamic nature of the real estate market. The median sales price for new houses in October 2023 stood at $409,300, with an average sales price of $487,000.

Factors Affecting Housing Prices

- Supply and Demand: Housing prices respond to the balance between supply and demand. When demand surpasses supply, prices tend to rise; conversely, an excess of supply may lead to price declines.

- Income and Population Growth: Increased income and population growth typically drive housing price appreciation, while reduced income and population decline may contribute to price decreases.

- Inflation and Interest Rates: High inflation or interest rates generally coincide with falling house prices, whereas low inflation or interest rates often lead to rising house prices. And let’s not forget lingering concerns about a recession.

- Consumer Confidence and Expectations: Optimism about the economy and positive expectations for future price increases encourage home purchases, whereas economic pessimism and anticipation of price declines can deter buyers.

- Government Policies and Regulations: Government interventions, such as subsidies or incentives for homebuyers, can elevate prices, while taxes or restrictions may lead to price reductions.

- Regional Variations: Local factors like climate, amenities, infrastructure, and cultural preferences contribute to regional variations in house prices, emphasizing the importance of considering location-specific dynamics in property analysis.

Analyzing these factors provides a comprehensive view of the property market, equipping buyers, sellers, and investors with valuable insights for navigating the ever-evolving real estate landscape.

Investment Opportunities in Real Estate

Is now the right time to invest in real estate? Absolutely. As Mark Twain wisely said, "Buy land, they're not making it anymore." Real estate's enduring value continues to rise, even if not at the remarkable rates seen in recent years. If you're maximizing tax-advantaged retirement accounts and seeking additional income and net worth growth without accumulating debt, this is an opportune moment to invest.

However, it's crucial to recognize that real estate investment requires effort and financial commitment. Understanding the landscape is essential for success in exploring rental properties, commercial real estate, or emerging markets.

The 10 Percent Rule: A Strategic Approach

1. No More Than 10 Percent Down Payment

Many real estate investors, aiming primarily for profit, follow the 10 percent rule, advocating not putting more than 10 percent down on a property. For investors, this approach ensures more liquidity for other potential investments.

Example: Purchasing a $150,000 property involves a $15,000 (10 percent) down payment. If the property appreciates by $15,000 in the first year, your actual investment doubles, providing a solid return.

2. Buy At Least 10 Percent Under Market Price

Avoid purchasing properties priced more than 10 percent under market value. This ensures the potential to recoup the initial down payment immediately, creating a favorable starting point for profit.

Tip: Look for undervalued properties through avenues like foreclosures, auctions, or recognizing factors that increase a home's value.

3. Never Pay More Than 10 Percent Interest

While the original rule is outdated due to today's lower mortgage rates, investors can set a personal rule for an acceptable interest rate. Current rates, around 7%, provide favorable conditions for real estate financing.

Advice: Consider your financial situation and set a rule for the maximum interest rate you're willing to pay, factoring in variables like credit history and down payment.

Maximizing Returns in Rental Properties

A good Return on Investment (ROI) for rental properties is generally considered to be around 8 to 12% or higher. The 10 Percent Rule complements this strategy, guiding investors toward properties with a balanced risk-to-reward ratio. Understanding and applying these principles enhance the potential for success in the ever-evolving real estate investment landscape.

Regional Real Estate Market Insights

The real estate market is like a patchwork quilt, with different regions showing various trends and patterns. It's a bit like painting – some places experience drops in home prices, like California, while more affordable spots in the Midwest and New England see prices going up. Instead of being a problem, these differences can actually be a smart move for investors, especially those interested in multifamily properties.

Regional Disparities

Different areas have different stories in the real estate world. While places with high demand, like California, are seeing home prices go down, others in the Midwest and New England are increasing prices. This mix isn't just a challenge; it's a good opportunity, especially for investors looking at multifamily properties.

Multifamily Opportunities in Different Areas

As it becomes harder to buy single-family homes, more people are looking for apartments and townhouses. This trend isn't the same everywhere; it depends on things like how much homes cost, job opportunities, and what people prefer. For investors in multifamily properties, these differences in regions can be a chance to make smart choices. Investors can make the most money by picking areas where many people want to rent.

Challenges and Chances for Multifamily Investors

In 2023, investors in multifamily real estate are dealing with a tricky situation. Home prices are going up, mortgage rates are changing a lot, and the overall economy is affecting things. The Federal Reserve, which helps control the money in the country, has made some changes that are making it harder for people to buy homes.

Refinancing is tough now, especially for deals where investors added value to the property. The multifamily market, which usually does well, also feels the effects of more apartments being built and how much people are willing to pay for rent. Even with these challenges, there are still chances for smart investors to do well.

Finding Chances in a Complicated Situation

Even though there are difficulties, the current situation is a chance for investors in multifamily properties. The differences in regions mean investors can spread their money around in a smart way. Even with challenges like interest rates increasing and costs increasing, investors who understand the situation can use their knowledge to make the most of opportunities in the multifamily real estate market.

Impact of Interest Rates and Economic Factors

Interest rate fluctuations and broader economic conditions play a significant role in shaping the real estate market landscape, impacting buyers, sellers, and investors alike.

Interest Rates and Housing Market Stagnation

With thirty-year mortgage rates reaching highs not seen in decades and home prices rebounding from a temporary dip, the housing market is experiencing a phase of relative stagnation. High costs are creating barriers for potential homebuyers, deterring them from entering the market.

Simultaneously, existing homeowners hesitate to sell, fearing the prospect of assuming more expensive mortgages required for purchasing new homes. This has contributed to existing home sales being on track for the lowest year since 1993.

Understanding Mortgage Types and Economic Influences

Mortgage loans come in two primary forms: fixed-rate and adjustable-rate, with various hybrid combinations and derivatives. Having a basic understanding of interest rates and the economic factors influencing their trajectory is crucial for making sound mortgage decisions.

These decisions encompass choosing between a fixed-rate mortgage and an adjustable-rate mortgage (ARM) or deciding whether to refinance out of an ARM.

The interest rate, the fee lenders charge to borrowers for using assets, is influenced by various economic factors, primarily set by a country's central bank. Central banks adjust interest rates based on economic conditions to manage inflation. Central banks tend to raise interest rates when inflation is high to discourage borrowing and slow consumer demand.

Role of the Federal Reserve (Fed) in Interest Rates

The Federal Reserve (Fed) is key in shaping interest rates. In periods of high inflation, the Fed is likely to raise interest rates. The market interprets the Fed's actions, influencing long-term interest rates like the yield on the U.S. Treasury 10-year bond. The Fed's management of short-term interest rates directly impacts longer-term rates, creating a ripple effect across the financial landscape.

Forecasting Mortgage Interest Rates

Understanding the correlation between 30-year mortgage rates and the U.S. Treasury's 10-year bond yield is crucial for predicting future interest rates. Monitoring the yield on the U.S. Treasury 10-year bond and staying attuned to market sentiments regarding Fed monetary policy provides insights into the potential trajectory of 30-year fixed-rate mortgage interest rates.

In conclusion, the intricate dance between interest rates and economic conditions significantly shapes the real estate market. Buyers, sellers, and investors can navigate this dynamic landscape more effectively by staying informed about economic indicators and understanding the interplay between interest rates and housing market trends.

Navigating the Terrain: Unlocking the Latest Real Estate Stats and Trends

Being in the know is your real estate superpower. We covered a lot – from the differences in regions to cool opportunities for investors and how economic factors affect the housing scene. We even looked at some fresh real estate stats, showing the highs and lows.

The big idea? Whether you're a buyer checking out places, an investor hunting for the best deals, or a homeowner thinking about the market, these trends and stats are gold. With the latest real estate info in your pocket, you're ready to make smart moves in buying, selling, or investing. It's like having a map – and you're in control of where you want to go.

The content on this page provides general consumer information or tips. It is not financial advice or guidance. Each person’s circumstances are unique. The Cash Store may update this information periodically. This information may also include links or references to third-party resources or content. We do not endorse the third-party or guarantee the accuracy of this third-party information. There may be other resources that also serve your needs.

More Articles

What to Know About Crypto-Backed Loans

Curious about using your crypto as collateral? Discover how crypto-backed loans work, their benefits, risks, and what to consider before borrowing.

Read More >How Does Installment Loan Approval Work?

Curious about how installment loan approval works? Learn about the key factors lenders consider, the application process, and tips to improve your chances of approval.

Read More >Is it Better to Get an Installment Loan or Line of Credit?

Installment loan or line of credit—which is right for you? Learn the key differences, pros and cons, and how to choose the best option for your financial needs.

Read More >Loan Amount is subject to loan approval. Loan terms and availability may vary by location. Approval rate based on complete applications received across all Cash Store locations. Customers can typically expect to receive loan proceeds in less than 20 minutes; however, processing times may vary. Loans / Advances are provided based on approved credit. Each applicant for credit is evaluated for creditworthiness.

Please see the Licenses and Rates page for additional product details.

Cash Store offers consumer credit products that are generally short-term in nature and not intended for long-term borrowing needs.

In Texas, Cash Store is a Credit Services Organization. Loans are provided by a non-affiliated third-party lender. Please see the Licenses and Rates page for links to Consumer Disclosures and choose the one for the product and amount that most closely relates to your loan request.

Customer Portal residency restrictions apply. Availability of funds may vary by financial institution.